TABLE OF CONTENTS

INTRODUCTION/OVERVIEW

THE PROFILOES OF AT&T INC

– SWOT ANALYSIS OF AT&T INC.

– AT&T INC. MERGED

– THE ACTIVITIES BETWEEN AT&T AND CONSUMERS

ANALYSIS THE BOARD OF DIRECTORS

CONCLUSION

WORKS CITED

WORKS CONSULTED

APPENDIXES

Introduction & Overview

“Rethink Possible. Connecting you to your world, everywhere you live and work.” – AT&T

AT&T incorporation is the largest American multinational telecommunications holding company, incorporated in 1983. (Mint Global –Company Report of AT&T Inc., 2011).The headquarter of the company is located in Whitacre Tower, Dallas, Texas in the United States. In 1984, AT&T Corporation was an American local telephone operation underan agreement with the U.S. Department of Justice and was affiliate of the SBC Communications Inc. Later on, SBC communications acquired AT&T Corp. in 2005, and created the new AT&T Inc. Today, AT&T Inc. employs “more than 260,000 dedicated people working in all corners of the globe”; at the same time, the services and the products of the company reach all over the world with revenues of $126 billion in 2011 (General Electric, 2012 a).The mission of AT&T Incorporation is “to connect people with their world, everywhere they live and work, and do it better than anyone else”. (AT&T: Rethink Possible, 2012). In the process of fulfilling its objects AT&T faces the fierce competitions from both local and international telecommunications. However, in spite of the large numbers of market sharers or competitors, as a market leader, AT&T actually incorporates its rivals to wheel the United States Telecommunications industry thus to exert a competitive advantage of AT&T. In fact, AT&T not only occupies the stable leading position in the United States, but also enjoys the unique relationships with their consumers, government and society, which would directly increase its revenues; in turn, expand their influence in the US market.

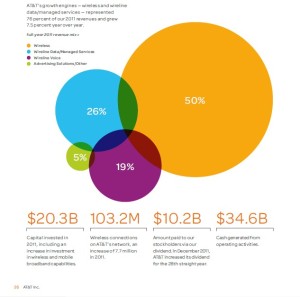

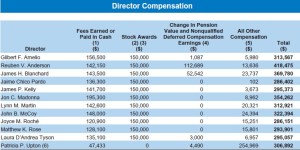

What are AT&T’s sources of income? What kind of the role does each of the broad of directors play in AT&T? Many sources and reports exhibit the fact that the services and products of the company contribute revenues and each director from different areas controls the company. For example, the pie graph provided by AT&T Financial Reporting depicts that the revenue in 2011, come from 50% in wireless data/ management services, 45% in Wireline voice services, and the last 5% is from advertising solutions and other usages (Appendix A). Furthermore, the Notice of Annual Meeting of Stockholders and Proxy Statement show that the principal occupation and committee of the currents board of directors (Appendix B).

In fact, the management of AT&T is facing several challenges. For instance, how the operations of AT&T can help the company to archive competitive advantages among the intense competitions in United States telecommunications market, how can the board of directors successful operate AT&T in the telecommunication industry, and how can the activities run by AT&T critically promote and retain customer loyalty. By answering these questions, this paper will run through different types of sources, such as the Financial Report and Proxy Statement of the company, and to discuss the profitability of the company and critically examine the board of directors of AT&T Inc.

The profile of AT&T Incorporation

AT&T is a provider of telecommunications services in the United States operating through 33 subsidiaries (Mint Global –Company Report of AT&T Inc., 2011). Its extensive coverage in the U.S. market directly improves the company’s economic performance. According to AT&T Inc. 2011 Annual Report, that the 33 subsidiaries can be divided into four segments, which include wireless, wireline, advertising solution and others; in addition, each of them makes profits and greatly contributes to the company’s economic blossom (AT&T Inc., 2012).Among these major segments, most of the company’s income comes from wireless and wireline services, which account for more than 95% of the company’s revenue (Mint Global – Company Report of AT&T Inc., 2011, p.4).

The leading wireless services subsidiary is the AT&T Mobility LLC (AT&T Mobility), which includes services such as wireless communications service, long-distance service and roam service. These services provide values and convenience to millions of individuals, business and government users and at the same time a stronger relationship is building between AT&T Inc. Company and its own consumers. As of December 31, 2011, the company has more than 103 million wireless subscribers nationally. A report from the Mint Global – Company Report of AT&T Inc.(2011), summarized that the wireless business segment of AT&T provides approximately 50% of the total operating revenues (p.4) to the corporation. Also, the business report of The Top Ten Telecom Service Providers claims AT&T Mobility are only provided in the US and contributed 35% of the total company revenues in the financial year of 2007 (2008, p.41), which demonstrates that the wireless segment is the leading business in AT&T.

Similarly, AT&T’s wireline segment also contributed approximately 47% of the total in the financial year 2011 (Mint Global –Company Report of AT&T Inc., 2011, p.5).The Top Ten Telecom Service Providers, explains that the main source of income from wireline services are fixed-line voice and data services to retail, wholesale and business customers both domestically and internationally. For additional information, please refer to the pie graph in Appendix A, which clearly demonstrated that the services of wireline segment included data/ managed and voice services as well as the revenues generated from this segment. (Appendix A).

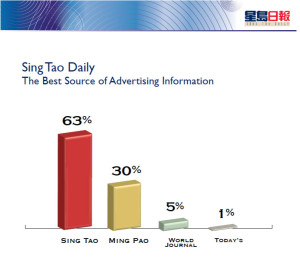

Besides wireless and wireline, AT&T Incorporation also earns money (makes profits) from business channels, such as advertising and publishing, but they only accounts5% the revenue earned in year 2011. The Mint Global Company Report summaries that the other segments of AT&T includes customer information services, advertising solutions, publishing, and investments in other companies such as Telefonos de Mexico, S.A. de C.V. and America Movil, S.A. de C.V (Mint Global –Company Report of AT&T Inc., 2011, p.7). For advertising solutions and publishing, AT&T publishes Yellow & White Pages directories; sells directory advertising and internet-based advertising as well as the local search advertising. This segment sells advertising services throughout the United States, with its print directory operations primarily in. 22 different states (Mint Global –Company Report of AT&T Inc., 2011, p.8). During 2011, the Advertising Solutions segment provided approximately 3% of the total operating revenues. Other services contributed 1% of the company’s revenues in 2007 and included operations of the company’s business integration software and services subsidiaries (Schuk, 2011, p.41). All together, these segments contributed 5% of the total revenues in 2007 (Schuk, 2011, p.41).

Today, AT&T Inc. has become the largest telecom company in the world with revenues of $126 billion in 2011, partly due to the “acquisition of BellSouth in 2006” (The Top Ten Telecom Service Providers Positioning, performance and SWOT analyses, 2008, p.18). The reports from Hoover’s Company Records – In-depth Records, 2012, AT&T Inc. states that AT&T has been using acquisitions as a growth strategy to buy-out smaller rival T-Mobile USA from Deutsche Telekom. The transaction valued at$39 billion in cash and stocks and as a result further expanded AT&T’s mobile data capabilities, service areas and subscriber numbers (LexisNexis Company Dossier, 2012, p.24). After the acquisition, AT&T had to pay Deutsche Telekom a break-up fee valued at about $6 billion, including $3 billion in cash, along with wireless spectrum licenses and a national roaming agreement worth another $3 billion (LexisNexis Company Dossier, 2012, p.24). In summary, AT&T’s 2011 Financial Statement displays the fact that the expensive acquisition of T-Mobile has substantially increase the company’s profits for 2011, and also represents that the acquisition has help the company to become the most recognized wireless carrier in the US (The Top Ten Telecom Service Providers Positioning, performance and SWOT analyses, 2008, p18).

SWOT Analysis of AT&T Inc.

As a market leader, the strengths of AT&T are clearly visible. As the leading telecommunication provider in the USA, AT&T has established a well-known and one of the most recognizable brands in the nation. The highly recognizable name allows the company’s products to be more noticeable in the highly competitive market and has the possibility of creating brand-loyalty through superior products and services. As well, the company currently has the biggest market shares in the United States, and with such large customer base the company can achieve higher profitability through operating efficiency and economy of scales. Furthermore, by acquiring competitors such as T-Mobile, AT&T is able to further increase their market shares, diverse their product lineups, and eliminating competitions. Last but not least, AT&T’s strong financial position in the US offers the opportunities to “further invest in new technologies and deployment of its IP network” (The Top Ten Telecom Service Providers Positioning, performance and SWOT analyses, 2008, p. 46).

Inversely, there are also weaknesses that exist in AT&T’s operations. For instance, although AT&T is the market leader in the USA, their operations are much limited in comparison. As US’s telecommunication and wireless service markets heading towards maturity, untapped foreign markets can be extremely attractive for large corporations. In addition, as AT&T has such large customer base, providing timely, quality customer services may be difficult and expensive for the company.

Opportunity wise, the telecommunication and wireless services are growing at an extremely fast pace in developing countries such as China and India. Similarly, acquiring the ownership interests in domestic and international corporations can help AT&T to further expand their influences in both of the domestic and foreign markets. From a technological perspective, AT&T has the financial resource and the technology to become a leader in 4G technology.

Aside from outside opportunities, external threats could hinder the operations of AT&T. The biggest threat faced by the company is the intensely competitive and increasingly saturated domestic market. Other telecommunication giants, such as Verizon Wireless are fiercely competing with AT&T for the position of the market leader. As well, the US market has reached its maturity and therefore does not offer huge potentials for long-term sustainable growth (Competitive Landscape, 2012, p. 64). Internationally, foreign political restrictions can increase the barrier of entry for AT&T. For example, until recently, Canada Government has not allowed foreign telecommunication companies to enter in Canada’s market. Even through this restriction has no longer exists; AT&T is still facing intense competition from Canadian firms.

A SWOT table is provided below:

| StrengthsMost recognizable brand in the USLargest customer base in the USDiverse products and servicesSound financial positions | WeaknessesLimited exposure in foreign marketsExpensive customer serives |

| OpportunitiesHigh potential foreign market | ThreatsIntense competitions, both domestically and internationallyForeign political interventions |

AT&T Inc. Merged

The strengths of operations of AT&T are bringing the opportunities, and positively influence company growth; otherwise, AT&T would encounter the risks from the highly competitive market in the United States and impose challenges on the growth of AT&T in the future. The report of The Top Ten Telecom Service Providers Positioning, performance and SWOT analyse confirms that the US [telecommunications] market is a highly competitive market (2008, p.48); however, AT&T not only faces furious competitions from other local telecommunication companies, but also has to share the market with them, at the same time, confront the challenge of “competitions from international firms operating in the US market” (The Top Ten Telecom Service Providers Positioning, performance and SWOT analyses, 2008, p.48). Because of the strong competitions, AT&T Corporation was broken up and merged on SBC on November 18th 2005 with changed name to AT&T Incorporation. After that, AT&T Inc. has been trying to outspread in telecommunications industry, so it purchased BellSouth completed on December 29th, 2006 with deal valued at more than $65 billion (Competitive Landscape, 2012, p.67). In 2011, “AT&T sought to merge with T-Mobile USA. Although the company has historically favored republicans in its political giving, people and political action committees can associated with AT&T” (The Mobile Enterprise: Moving to the Next Generation., n.d.).To sum up, the mergers of AT&T Inc. help the company to prosper; meanwhile, expand its shares in new markets, and therefore increase their size in existing markets.

The activities between AT&T and consumers

Likewise, the company of AT&T Inc. also provides high-quality services for its consumers as well as government, which strengthens the benign relationship among them. The strengthened relationship would create a win-win situation, and increase profits to the company. The conventional telecommunication of AT&T Inc., brings revolutionary smartphones, next-generation TV services, broadband network and some other services all together for both customers who are in the US and multi-national businesses located in the most countries, which can be the new solutions crossing through the worldwide for consumers and businesses by “driving innovation in the communications and entertainment industry” (AT&T: Rethink Possible, 2012).The official website of AT&T concludes that “AT&T is the only national U.S. TV service provider to offer a 100-percent IP-based television service” to the consumers, which focused on delivering the high-quality customer service that is AT&T heritage (AT&T: Rethink Possible, 2012).

Furthermore, AT&T might be best known for its consumer phone service; however, the use of its technology to track business, which cannot be underestimated. For the government, AT&T applies AT&T Government Solutions, which are a business unit within AT&T Corp (NYSE:T) and a provider of network-enabled solutions for the US federal government AT&T (Government Solutions announces selection as prime vendor for US DHS., 2012). This shows the relationship between the government and company. On the other hand, the operation conflicts are also coming off between AT&T and government. According to the news from August 31st 2011, AT&T has ended its effort of buying T-Mobile USA, acknowledging that it could not overcome stiff opposition by the U.S. government to form the United States’ biggest cellphone service provider (Murph, 2011), which prove the news about when the deal of AT&T merger small rival T-Mobile USA fell apart amid strong government opposition in 2012, also displays the direct governmental manipulations or interventions toward company policy.

Board of directors of AT&T Inc.

Just like any other public corporations the board of directors of AT&T are elected by shareholders and they are mainly responsible for overseeing the performance of the upper management, ensuring that the management is acting upon the best interest of the shareholders, and establishing overall broad corporate policies to make sure the company is maximizing values for shareholders.

The 2012 Proxy Statement of AT&T Inc. provides several tables to present the basic information on the current board of directors of the company, as well as summarizes the common stock ownership of major shareholders. The Proxy Statement report states that there are 12 board of directors who are also shareholders that have attended the AT&T Inc. 2012 Annual Shareholder Meeting. These directors are Randall L. Stephenson, Gilbert F. Amelio, Reuben V. Anderson, James H. Blanchard, Jaime Chico Pardo, James P. Kelly, Jon C. Madonna, Lynn M. Martin, John B. McCoy, Joyce M. Roché, Matthew K. Rose, and Laura D’AndreaTyson (General Electric, 2012c).

Among the 12 board of directors, there are only 3 female directors: Martin, Tyson, and Roché, which means that women occupy 25% of the total seats on the board. As a matter of fact, this percentage of the female board member is much higher than most companies. What is more, even though there are only four outside directors among 12 nominees, namely Tyson, Pardo, Madonna, and Kelly, the qualifications of each director is preeminent and can greatly contribute to the operation of AT&T Inc. despite of the lower ratio compared to other companies.

For example, James P. Kelly is 68 year old, who was the Chairman of the Board and Chief Executive Officer of United Parcel Service, Inc. from 1997 until 2002 in Atlanta, Georgia. During that period of the time, the company of United Parcel Service has “grew beyond its core package delivery business to become a global supply chain management concern” (Corporate Governance, 2012). In 2000, Mr. Kelly has been as a Director of BellSouth. Until the company was acquired by AT&T in 2006, Kelly became one of the boards of directors, who was working on both the Audit Committee and the Corporate Governance and Nominating Committee. At the same time, he has also directed another two companies, such as Dana Corporation (2002-2008) and Hewitt Associates Inc. (2002-2007) (Corporate Governance, 2012). As a board of director the qualifications of Mr. Kelly are positively boosting his achievement in management. For instance, “Kelly has extensive experience in the executive oversight of a complex, multinational organization and his vast experience in strategic planning, logistics, and consumer marketing, all issues that AT&T faces as a large, international company. His qualifications also include his six years of service as a director of a telecommunications company that we acquired” (General Electric, 2012c).

Next, Madonna, age 68, is the Chair of the Audit Committee. From 1990 – 1996, he worked as senior leader at KPMG (an international accounting and consulting firm in New York, New York). After that, Mr. Madonna jointed Travelers Group Inc. from 1997 to 1998 and President and Carlson Wagonlit Corporate Travel, Inc. from 1999 to 2000. After that, he was working in Digital Think Inc. which is an e-commerce company, from 2001 to 2004. Mr. Madonna served as a Director of AT&T Corp. from 2002 until now. At the same time, he has also served other four companies, such as Freeport-McMoRan Copper & Gold Inc. , Tidewater Inc., Jazz Technologies Inc. (2007-2008), Phelps Dodge Corporation (2003-2007); and Visa U.S.A. Inc. (2006-2007). (Corporate Governance, 2012).Mr. Madonna has such a wealth of work experiences, which give him strong executive leadership skills. Likewise, his rich experience in public accounting, which gained from a major accounting firm that he worked for, as well as his familiarity in international business and affairs, all strongly attribute to the Board of AT&T. His qualifications also include his service as a director across diverse, publicly traded companies, including his prior service on the board of a telecommunications company that we acquired (General Electric, 2012c).

Furthermore, Laura D’Andrea Tyson, who is one of the female directors in AT&T Inc., 64 year old. She has very sophisticated expertise in economic, management and business domain because she had been working as a professor of business at Dean of London Business School, London, England, from 2002 until 2006, and Haas School of Business at the University of California at Berkeley from 1998 to 2001. Dr. Tyson. Also, Dr. Tyson has been a member of the Council on Jobs and Competitiveness, Economic Recovery Advisory Board, and National Economic Adviser for the President of the United States. She has been taking up a position of director of at AT&T since 1999 and she is a member of the Audit Committee, the Corporate Development Committee and the Finance/Pension Committee. “The qualifications of Dr. Tyson to serve on the Board include her expertise in economics and public policy, her experience as an advisor in various business and political arenas, and her vast knowledge of international business and affairs, all strong attributes for the board of AT&T. Her qualifications also include her experience serving as a director of several publicly traded companies, as well as her prior service as a director of a telecommunications company that we acquired”(General Electric, 2012c).

The table that lists the Current Board Members is provided in the Proxy Statement and contains basic information, such as age, sex, number of years on the board, principal occupation, and committees of the directors regarding each director (Appendix B). In the table, it shows that all the directors’ ages are ranged from 51 to 72 years old. The Chairman of the Board, who is also the Chief Executive Officer and President of AT&T Inc., is Randall L. Stephenson. He is 51 years old as of 2012 which is also the youngest member of the board. In contrast, Lynn M. Martin is the oldest director currently serving on the board. The average age of all the directors is 64.8 year old and the average age of women directors is around 66.7,which can be an advantage directly reflects on the running of the company. Since the ages of all the directors are around senior year, ages display that all the directors may have professor experiences, which assists AT&T Inc. become more stable. For the longest serving board members, Martin, McCoy, Roche and Tyson all have been on the board for over a decade, dating even before the year 2000. Roche is the oldest director in AT&T who has been with the company since1998. On the other hand, Jaime, who is in charged with audit and corporate development is the youngest director and has been with the company for 4 years. The median number of years of serving on board is 8.5 years, but it also represents that the board of AT&T Inc. is stable, which would be one of the positive aspect on the growth of the company.

Likewise, the table also shows the different principal occupations and committees of each director. Generally speaking, the board can be divided into 7 different committees, and they include Executive, Human Resources, Public Policy, Finance and Pension, Corporate Governance and Nominating, Corporate development, and Audit. The table below lists all the committees as well as the corresponding board members who take charge of the committees (Notice of Annual Meeting of Stockholders and Proxy Statement, 2012):

| COMMITTEES | NUMBER OF DIRECTORS | NAMES |

| Executive | 7 | Stephenson, Amelio, Anderson, Blanchard, Madonna, Martin, McCoy |

| Public Policy | 4 | Amelio, Anderson, Roché, Rose |

| Finance/ Pension | 4 | Anderson, Martin, McCoy, Tyson |

| Human Resources | 3 | Amelio, McCoy, Rose |

| Corporate development | 4 | Blanchard, Pardo, Madonna, Tyson |

| Audit | 4 | Pardo, Kelly, Madonna, Tyson |

| Corp. Gov. and Nominating | 4 | Kelly, Martin, Roché, McCoy |

Directors in different committees have different responsibilities and obligations. For example, the Corporate Governance and Nominating Committee include 4 board members. According to Proxy Statement, these directors are responsible for identifying candidates who are eligible under the qualification standards set forth in the Corporate Governance Guidelines to serve as members of the Board. For example, Stephenson, Randall L., who is a Chairman, CEO, and President, of AT&T Inc. At the same time, he also is the chairman of the Executive Committee who has the authority to exercise all the power within committee. More importantly, other board directors as well as upper management are under his direct command (Corporate Governance, 2012). James H. Blanchard, the chair of Corporate Development and Finance Committee of the board of Directors of AT&T Inc. In his committee, all the members have the power to review and manage the financial status, capital structure, financing activities and pension matters of AT&T Inc. Also, Financial Committee shall annually evaluate the Committee’s own performance and share such evaluation with the Corporate Governance and Nominating Committee (Corporate Governance, 2012).

In the end, after viewing the operation of AT&T Inc. and the qualifications of each director, some interlocks within the board can be discover and other major companies, such as National Lambda Rail , Apple and Google, Verizon and Sprint Nextel Corp, which can also bring benefits and assist the future growth of AT&T Inc. According to Digital Journal, July 25, 2012 the company National Lambda Rail (NLR) and AT&T Inc. jointly contribute the networking solution to “virtually connect major cancer centers, universities, medical schools, research hospitals, laboratories and other institutions across the United States” (The Caring Network: National Lambda Rail and AT&T Collaborate on High-Speed Network Connections for Leading Health Sciences Institutions, 2012, para5), which not just help institutions to be involved in illness prevention program, and also attract large amount institutions to participate in the program; thus increasing business consumers can raise the revenues for both NLR Inc and AT&T Inc. Furthermore, AT&T Inc. also has the connections with both Apple Inc. and Google Inc., which caused AT&T to add almost 1.3 million more wireless customers in the reported quarter, totaling 105.2 million in income. Moreover, “strong additions were attributable to the continued adoption of smartphones by Apple Inc. ‘s ( AAPL ) iPhones and Google Inc .’s ( GOOG ) Android based phones as well as increased sales of tablets and connected devices such as automobile monitoring systems and security systems” (Equity,2012, para7).

On the other hand, AT&T Inc. also shares market with its competitors, such as Verizon Inc. and Sprint Nextel Corp. AP Technology Writer Peter Svensson (2012) in his article summarized that AT&T shares data plans with its competitor Verizon, which is “intended to stimulate the adoption of non-phone devices such as tablet computers and USB modems for laptops by making monthly service cheaper” (p.1). In addition, the advantages of market sharing can increase more consumers and weaken the local competition. Thus, AT&T Inc. establishes interactions and connection with other companies, which can benefit them with income increasing and competition alleviating in the United States market.

Conclusion

In conclusion, AT&T Inc. is successful in the United Stated Telecommunications Industry because it provides the innovative, reliable, high-quality products and services and excellent customer care, while all the above characteristics lay foundation for their healthy return. Besides, AT&T also has the powerful and effective management running through the whole corporation thus is capable of meeting various demands from different market consumers and competitors of both the local and the international markets. Furthermore, AT&T Inc. also merges and integrates some major companies to better adapt the tough competitions in the United States. What is more, it balances the operations and all types of committees’ settings can benefit the income and consumers at the same time. In fact, the composition of its consumers can be diverse such as business or government. However, they all work to influence the media industry in the face of formidable globalization in USA.AT&T Inc. has created significant advantages through their special operation systems, and they have developed to manage all kinds of dynamic activities through each committee. The data from AT&T Inc. Official Websites and Proxy Statement have provided specific table to show how AT&T Inc. manage to make profits and how board of directors serve the company as well as what kind of interlocks between AT&T Inc. and other companies, which are wonderful and useful sources for this assignment. The four segments of AT&T Inc. show that how AT&T Inc. earns revenue from consumers. By reviewing and comparing the 12 board of directors in the annual meeting of stockholders on April 27th, 2012, each stockholder presented that they occupied different positions in the committee, which contributed to the overall the operations of AT&T Inc. Comparing the current AT&T Inc. with other major companies in the United States telecommunications industries, AT&T Inc. offers different services to consumers and other companies, which incorporate, integrate and globalize different kinds of consumers and business and if combined jointly, they also can forge AT&T Inc. a strong brand and make it a big winner in the telecommunication industry in the United States.

Works Cited

AT&T Government Solutions announces selection as prime vendor for US DHS. ( 2012, May 16) Telecomworldwire. Retrieved from http://www.lexisnexis.com.proxy.lib.sfu.ca/hottopics/lnacademic/

AT&T Inc. ( 2012, June 22). Thomson Financial Thomson Extel Cards Database.Retrieved from http://www.lexisnexis.com.proxy.lib.sfu.ca/hottopics/lnacademic/

AT&T: Rethink Possible. (2012). AT&T Inc. Company Information.Retrieved July 7, 2012 fromhttp://www.att.com/gen/investor-relations?pid=5711

Corporate Governance.(2012). AT&T Inc. Investor Relations.Retrieved July 20, 2012, from http://www.att.com/gen/investor-relations?pid=5633

Competitive Landscape. (2012). USA Telecommunications Report, (2), 67-78.

Equity, Z.( 2012 July 24).AT&T Beats on Record Wireless- Analyst Blog. Nasdaq. Retrieved fromhttp://community.nasdaq.com/News/2012-07/att-beats-on-record-wireless-analyst-blog.aspx?storyid=158130

LexisNexis Company Dossier. (2012). General Electric: AT&T Inc. Retrieved July 11, 2012, from http://w3.lexisnexis.com.proxy.lib.sfu.ca/dossier/delivery/downloadDoc.do?prod=CD&cdcomp=9b07dda040401da35e38cd56500be847%3A9b07dda040401da35e38cd56500be847%3A6_T478511887&dnldFileName=LexisNexis_Dossier.PDF&jobHandle=1825%3A359838047&host=Rosetta_US_Academic&fileSize=60952

General Electric.(2012 a).AT&T Inc. Location. Retrieved July 7, 2012 from http://att.jobs/location.aspx

General Electric.(2012 c).Definitive Proxy Statement. Retrieved July 20, 2012, from http://www.sec.gov/Archives/edgar/data/732717/000119312512109414/d282492ddef14a.htm

General Electric.(2012 d).AT&T Inc. 2011 Annual Report. Retrieved July 7, 2012 from http://www.att.com

Mint Global –Company Report of AT&T Inc. (2011, December 31). Mint Global.Retrieved from https://mintglobal-bvdep-com.proxy.lib.sfu.ca/version-2012620/Report.Build.serv?_CID=58&context=3AHL7XJJ6UC2J6R&SeqNr=0

Murph, D. ( 2011 August 31). US government files to block proposed AT&T / T-Mobile merger (update: companies respond). Bloomberg.Retrieved fromhttp://www.engadget.com/2011/08/31/us-government-files-to-block-propsed-atandt-t-mobile-merger/

Notice of Annual Meeting of Stockholders and Proxy Statement. (2012 March 12). AT&T Inc. Retrieved July 20, 2012, from http://www.att.com/Common/about_us/annual_report/pdfs/att_2012_proxystatement.pdf

Schuk, C. (2011). Strategies for Delivering Multi-Play Consumer Services The architrcture of user-centric services.Business Insights Ltd. Retrieved from http://360.datamonitor.com.proxy.lib.sfu.ca/Product?pid=BI00052-007&view=d0e1531

Syensson, P.(2012). AT&T introduces shared data plans. Kansascity.Retrieved from http://www.kansascity.com/2012/07/18/3710653/att-to-introduce-shared-data-plans.html

The Caring Network: National LambdaRail and AT&T Collaborate on High-Speed Network Connections for Leading Health Sciences Institutions. (2012 July 25). Digital Journal.Retrieved from http://www.digitaljournal.com/pr/809022

The Mobile Enterprise: Moving to the Next Generation. (n.d.)AT&T Inc.Retrieved from http://www.opensecrets.org/orgs/summary.php?id=D000000076&lname=AT%26T+Inc

The Top Ten Telecom Service Providers Positioning, performance and SWOT analyses. (2008). Business Insights Ltd. Retrieved from http://360.datamonitor.com.proxy.lib.sfu.ca/Product?pid=BI00029-015

Works Consulted

AT&T barges into home security and automation. (2012 May 7)..Associated Press. Retrieved from http://www.salon.com/2012/05/07/att_barges_into_home_security_and_automation/

AT&T Inc. (n.d.).Hoover Vers.Retrieved from http://www.hoovers.com/company/ATT_Inc/rryksi-1-1nji3j-1njhft.html#

AT&T Inc. (n.d.). In Wikipedia. Retrieved July 21, 2012, from http://en.wikipedia.org/wiki/AT%26T

Crain, R. (2012, June 18). Why business-to-business advertising is increasingly also aimed at consumers (P. 16, Vol. 83). Advertising Age. Retrieved from http://www.lexisnexis.com.proxy.lib.sfu.ca/hottopics/lnacademic/

General Electric. (2012b). AT&T Inc. Retrieved July 6,2012 from http://ca.finance.yahoo.com/q/co?s=T

General Electronic. (2012 March 31).U.S. Securities and Exchange Commission : AT&T Inc. (Filer). Retrieved from http://www.sec.gov/cgi-bin/viewer?action=view&cik=732717&accession_number=0000732717-12-000037&xbrl_type=v#

Inung, J., Gayle, P. G., & Lehman, D. E. (2008). Competition and investment in telecommunications. Applied Economics, 40(3), 303-313. doi:10.1080/00036840600592882

Ruddock, D. (2011, March). Chitika: Verizon Losing Android Market Share, AT&T And Budget Carriers On The Rise. Retrieved from http://www.androidpolice.com/2011/08/17/chitika-verizon-losing-android-market-share-att-and-budget-carriers-on-the-rise/

PR Newswire. (2012, July 9). AT&T Brings More Second-Screen Features, Content To U-verse Customers on iPhone, iPad & iPod touch, and Online. Retrieved from http://www.marketwatch.com/story/att-brings-more-second-screen-features-content-to-u-verse-customers-on-iphone-ipad-ipod-touch-and-online-2012-07-09

Verizon Communications. (n.d.). In Wikipedia. Retrieved July 21, 2012, from http://en.wikipedia.org/wiki/Verizon_Communications

Appendix A

Appendix B